Content

This is a transaction that needs to be recorded, as Printing Plus has received money, and the stockholders have invested in the firm. On January 23, 2019, received cash payment in full from the customer on the January 10 transaction. The dollar value of the debits must equal the dollar value of the credits or else the equation will go out of balance. Journaling the entry is the second step in the accounting cycle. Establishes guidelines for the reporting of expenses.

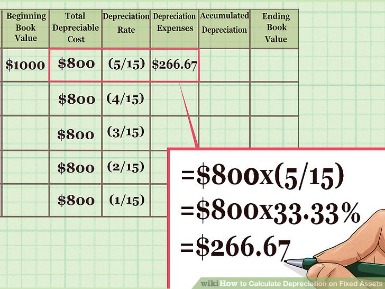

Expenses are recognized based on the matching principle, which holds that they should be reported in the same period as the revenue they help generate. Both entries will affect the accounting equation as the purchase of equipment would increase the assets side and the payment in cash would decrease the asset side. Accrued ExpenseAn accrued expense is the expenses which is incurred by the company over one accounting period but not paid in the same accounting period. In the books of accounts it is recorded in a way that the expense account is debited and the accrued expense account is credited. It is the summary of debits and credits of financial transactions with a note of which accounts these financial transactions will affect, maintained in chronological order.

An introduction to opening balances

But before transactions are posted to the T-accounts, they are first recorded using special forms known as journals. 1In larger organizations, similar transactions are often grouped, summed, and recorded together for efficiency. For example, all cash sales at one store might be totaled automatically and recorded at one time at the end of each day. To help focus on the mechanics of the accounting process, the journal entries recorded for the transactions in this textbook will be prepared individually.

Always make sure to account for uncleared bank checks and other factors. Opening balance equity is an account created by accounting software to offset opening balance transactions. You want the total of your opening journal entry examples revenue account to increase to reflect this additional revenue. Revenue accounts increase with credit entries, so credit lawn-mowing revenue. This will go on the debit side of the Supplies T-account.

Example #4 – Liability Accounting

How you make the change will depend on the type of opening balance and it’s status. Example – Goods worth 100 purchased on credit from HM Ltd. returned by us. Purchase Returns are the goods returned by the company to the seller or creditors. Sales returns are the goods returned by customers or debtors to the company. At the time of transferring interest to the P&L appropriation account. Adjusting entry when the income is actually realized.

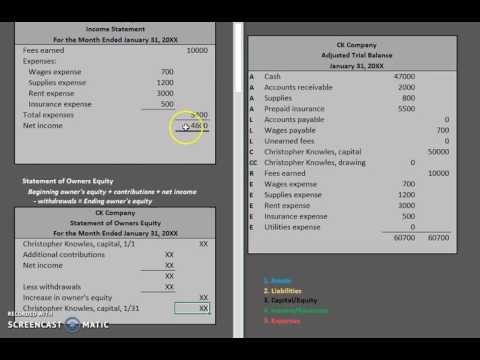

E record some transactions which are inter-connected and take place simultaneously by means of a compound journal entry. For example, we record the receipt of cash from a debtor and allowance of discount to him through a single journal entry. In formatting the balance sheet, you can have assets on the left side and the liabilities and owner’s equity on the right side. You can also just list them out, but the order is always assets, liabilities and then owner’s equity.

Managing Opening Balance Equity for Presentable Balance Sheets

Amortization is the same as depreciation but is charged as an expense only on intangible assets. Example Part 1 – Interest income of 2,500 related to the current year is due on the balance sheet date. At the time of paying an expense before the due date in cash. Example Step 1 – Electricity Expense of 1,000 is unpaid on the balance sheet date. When a business commences and capital is introduced in form of cash. Make your balance sheet look more professional and clean by clearing the balance in this account and bringing it to zero.

- Fund, petty cash is debited, and the cash account is credited.

- At the same time, inventory costing $2,000 is surrendered by the company.

- Next is a comprehensive example to show how each transaction is dealt with.

- To help focus on the mechanics of the accounting process, the journal entries recorded for the transactions in this textbook will be prepared individually.

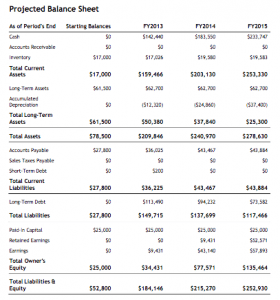

- Companies use balance sheets to track their assets, liabilities and owner’s equity.

- Journal Entry For Accounts ReceivableAccount receivable is the amount the company owes from the customer for selling its goods or services.

What is included in opening entry?

An opening entry is the initial entry used to record the transactions occurring at the start of an organization. The contents of the opening entry typically include the initial funding for the firm, as well as any initial debts incurred and assets acquired.