Content

You make contributions with after-tax dollars, but the money can grow tax-free and withdrawals up to the amount of premiums paid are not taxed. Lastly, a tax deduction is a deduction that reduces a tax payer’s tax liability by reducing his adjusted gross income and potentially, taxable income. The more deductions you can find, the higher your potential for lowering your tax bill. The SECURE Act was part of the December 2019 tax package and it includes several provisions that affect your retirement planning and tax planning strategies. The SECURE ACT includes several key changes that affect tax reduction strategies for high-income earners.

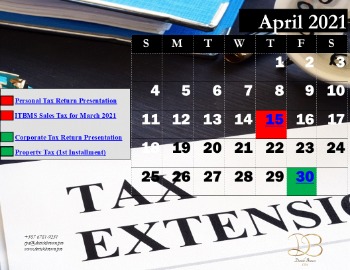

Property tax is one of the more complicated ways of reducing taxable income. Before paying your property tax early, talk to your tax preparer to determine whether you’re vulnerable to the alternative minimum tax. If you are self-employed, you can reduce your taxable income by claiming all of the business deductions available to you. You can claim business deductions on full- or part-time self-employed income.

Accelerate deductions and defer income

These range from claiming unsubstantiated charitable deductions to overstating travel expenses. It can also include paying your children or spouse for work that they did not perform. The IRS is always vigilant when it comes to inflated deductions from pass-through entities. Enabling tax and accounting professionals and businesses of all sizes drive productivity, navigate change, and deliver better outcomes.

- Charitable remainder trusts disperse income to beneficiaries for an established period of time before the remainder is donated to charity.

- Getting tripped up in the complexity and having the IRS disregard your planning strategies does not.

- The federal income tax is designed to tax higher levels of income at higher tax rates.

- A qualified charitable distribution is a distribution from an IRA owned by an individual age 70 ½ or over that is paid directly from the IRA to a qualified charity.

- Let an expert do your taxes for you, start to finish with TurboTax Live Full Service.

Along with airline tickets, rides to and from the airport and travel by car, railbus, and ferry are also deductible. The IRS pays close attention to transactions that involve taxpayers who have close business or family relationships. In fact, the tax laws have given the IRS special powers to deal with specific areas where related taxpayers have historically used their relationships to unfairly reduce their taxes. While the IRS can step in and reclassify a transaction based upon its substance, rather than its form, taxpayers often find that they have to live with the consequences of their initial choices.

Contribute to a 401(k) or traditional IRA

You won’t have to pay taxes on capital gains, and the charity won’t have to pay them, either. Some forms of income are not taxable, thus if you receive one of those forms of income, it is tax-free. And lastly, there are lots of capital gain tax exemptions that will either reduce or fully eliminate your tax liability. Investments involve risk and does with possible loss of principal and does not guarantee that investments will appreciate. Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve.

If you have a high-deductible health care plan, you can reduce your taxable income by contributing to an HSA. A health savings account allows you to make tax-deductible contributions, What Are The Best Ways To Lower Taxable Income? earn tax-free interest, and withdraw tax-free funds for eligible medical expenses. The 2023 contribution limits are $3,850 for individual coverage and $7,750 for family coverage.

Where’s My Refund? Tracking the Status of Your Tax Return

Most of us want to lower our income tax bills, and with a little bit of planning, there are ways you can. When thinking about how to lower taxable income, https://quick-bookkeeping.net/ consider these easy tips. First, a property with a good location may appreciate in value through time, resulting in a capital appreciation.

For 2023, the maximum deductible contribution level is $3,850 for an individual and $7,750 for a family (up from $3,650 and $7,300, respectively, in 2022). These funds can then grow without the requirement to pay tax on the earnings. An extra tax benefit of an HSA is that when used to pay forqualified medical expenses, withdrawals aren’t taxed, either. The IRS has detailed rules about whether—and how much—you can deduct. When used in the course of daily business, many expenses can be deducted from income, reducing the total tax obligation.

Increasing annual contribution limits for 401 and 103 accounts to $19,500 and to $13,500 for SIMPLE IRAs. The contribution maximum for Traditional and Roth IRAs will increase to $6,500 per year, effective 2023. The SIMPLE IRA allows contributions of up to $15,500 in 2023, plus an additional $3,500 for those age 50 and older. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

- An employer-sponsored 401 or a similar tax-deferred retirement plan will allow employees to make tax-deductible contributions to save for their future.

- Keep in mind that the requirements for this withdrawals to be income tax free are quite stringent.

- If you have big deductible purchases, make them by the end of the tax year to reduce your taxable income and spread your tax burden across tax years.

- If you earn above that to certain cut-offs, you can deduct a pro-rated amount.

- In a carry-over model, you can carry over up to $500 of unused funds to the following tax year.

- Those who donate securities like stocks still qualify for a deduction of up to 30% of their adjusted gross income.